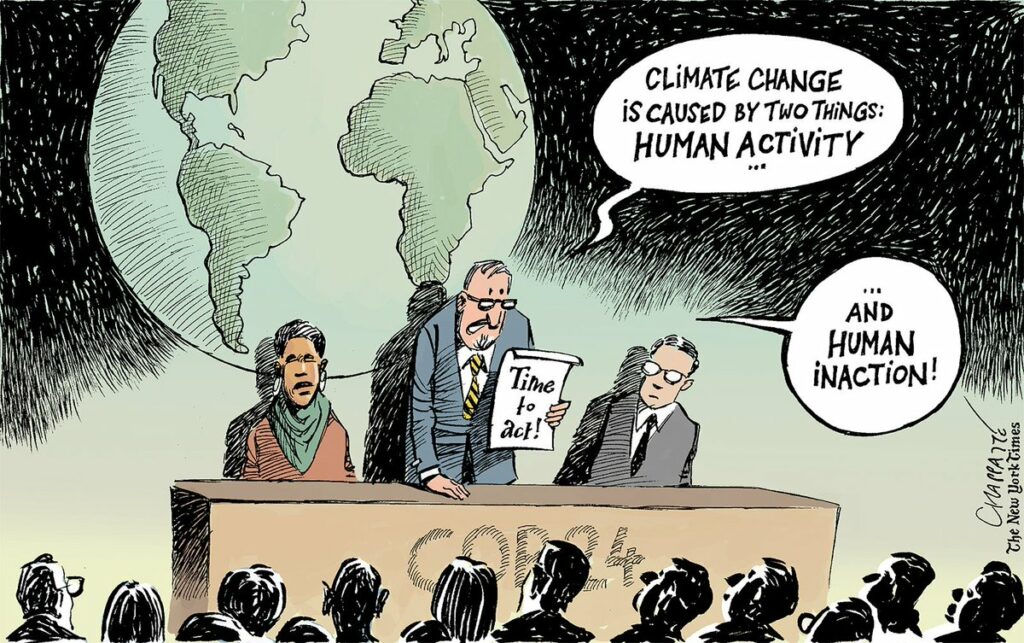

In light of last month’s UN Climate Conference in New York there are certain things we’d like to address. Greta Thunberg’s impassioned speech called out international leaders for their weakness in dealing with the Climate Crisis. For those of us working daily with facilitating the transition toward a greener economy we find her bravery truly encouraging, not least the global movement she has inspired. Unfortunately, the subsequent pledges made by leaders at the summit did not live up to expectations. Once again, they were predictably underwhelming. The announced efforts are clearly inadequate to address the climate challenge our civilization now faces. At the same time there is great hesitation amongst global leaders to take the necessary steps for instigating the profound changes needed. Political calculations for driving forward climate action is being weighed against options of doing nothing or merely conducting superficial policy makeovers. Despite vast scientific consensus on the dire consequences of continuing to emit at current pace, the fact of the matter is that we are, simply put, struggling with climate inaction–as we have been over the past thirty years.

One of the pivotal moments in Thunberg’s speech was her point about the folly of countries tying their fortunes to the measure of GDP and perpetuating economic growth rates. Indeed, economic growth has no real virtue if it’s not gauged against its cost. But furthering economic development and growth does not need to come at the expense of the environment and climate. What we need now is quick transition towards “smart growth” driven by technological solutions that we have available today. It is no longer a question of waiting for the right technology to materialize or more research to be done. It’s about the willingness to employ capital, resources and manpower to scale up solutions that have real impact. Governments, investors and corporations possess this capability. However, it should be the market that determines the winners and losers. Winners will be defined by their ability to differentiate through green technology adoption enabling them to reach carbon neutrality. “Going green” is a competitive advantage for attaining profitability and long-term business sustainability.

The science on Climate Change is crystal clear. The question now is how best to deal with this crisis and what actions need to be taken in order to circumvent disaster. Some hold our basic economic model, market capitalism, to blame for the situation we are finding ourselves in–and that this model is inimical to saving the planet. Market failures, overexploitation of natural resources, not to mention failure to internalize the real costs of pollution are claimed to be resultant outcomes. Although there are countless variants of capitalist systems around the world, many of which have fostered greed or hazardous market behavior. In our view market capitalism has accelerated human and technological development previously unseen in any period of human history. More crucially it has served the strongest, most intrinsic force there is: the exchange of ideas, human capital, goods, resources and perhaps most importantly, knowledge. What we need right now is a collective sense of commitment and urgency to propel real action. In no other arena can this happen more effectively–or disseminate faster–than where it is in fact market driven. Now that the world desperately needs to spend trillions on transitioning to greener, more efficient and sustainable ways of preserving life, we need to leverage the efficiencies of the market to make that a reality.

Businesses are implementing sustainability and environmental compliance measures like never before. Within few years noticeably “all” corporates have established strategies incorporating sustainability into their baseline. However, real change cannot be obtained if operating conditions do not change on the ground. Industrial manufacturers are still widely exempt from fuel taxes and carbon levies or enjoy strong subsidies from their states. They therefore have little incentive to alter their business or production methods. Carbon price increases are starting to take a toll on company bottom lines, yet evidently more is needed to tip the scale. The measures, incentives and rewards for adopting environmental technologies as it stands today are still far too weak and fragmented. Governments and legislators need to bring out more targeted firepower to facilitate real change within their industries. The cost of transition must be borne by corporations, the public sector and other stakeholders alike without skewing fundamental market mechanisms.

Bill Gates recently made a very valid point: Divesting from energy companies with high carbon footprints is not going to reduce CO2 emissions–we must place investments where they matter–forging way for new, greener technologies to disrupt the energy system and enabling these to scale. However, we need risk-takers from the whole spectrum, not just governments and institutional players. Increasingly it appears that leading investors, portfolio managers and investment banks deem not having green companies in their portfolio a to be liability and competitive disadvantage. Recent economic research has shown that climate and environmental concerns positively impacts investor expectations, capital allocations, and consequently pricing and returns. More importantly decarbonized portfolios perform better overall. Yet too many economies have charged critical financing tasks to semi-governmental investment funds with half-baked mandates to ferry promising companies across the “valley of death” into market. Many of which neither possess the required technical knowledge or market insights. Clearly, combinations of both public and private equity are required for de-risking and scaling up green technology successfully.

We can enact change if there’s will, know-how and ingenuity–but the time to act is now. Tremendous achievements have been made in deploying zero emission systems like solar and wind over the last decades. Renewable power is poised to become cheaper than fossil-fuel based, outcompeting these in already many markets. But curbing emissions in the power sector is just one side of the equation. Electrification of industry and minimizing fossil fuel consumption in manufacturing is equally critical. For sustainable development to accelerate, the pricing of carbon needs to reflect the real cost of polluting. There are already available technological solutions in the market with vast decarbonization potentials. Some corporates are indeed ahead of the curve in investing in these technologies, yet too many choose to “sit on the fence”. With no real pressure to reform there is little incentive to act. But we cannot rely solely on regulating our way to a carbon neutral world. Reaching ambitious emission targets will remain elusive unless we make the hard choices for implementing the required means. This generation-defining challenge demands participation, cooperation and buy-in from all actors. We need politicians and lawmakers, entrepreneurs and industrialists, social campaigners and green activists, and yes–even the traders on the floors of stock exchanges across the globe. Only then can we tackle the Climate challenge within this very short time.